Sentinel staff report–

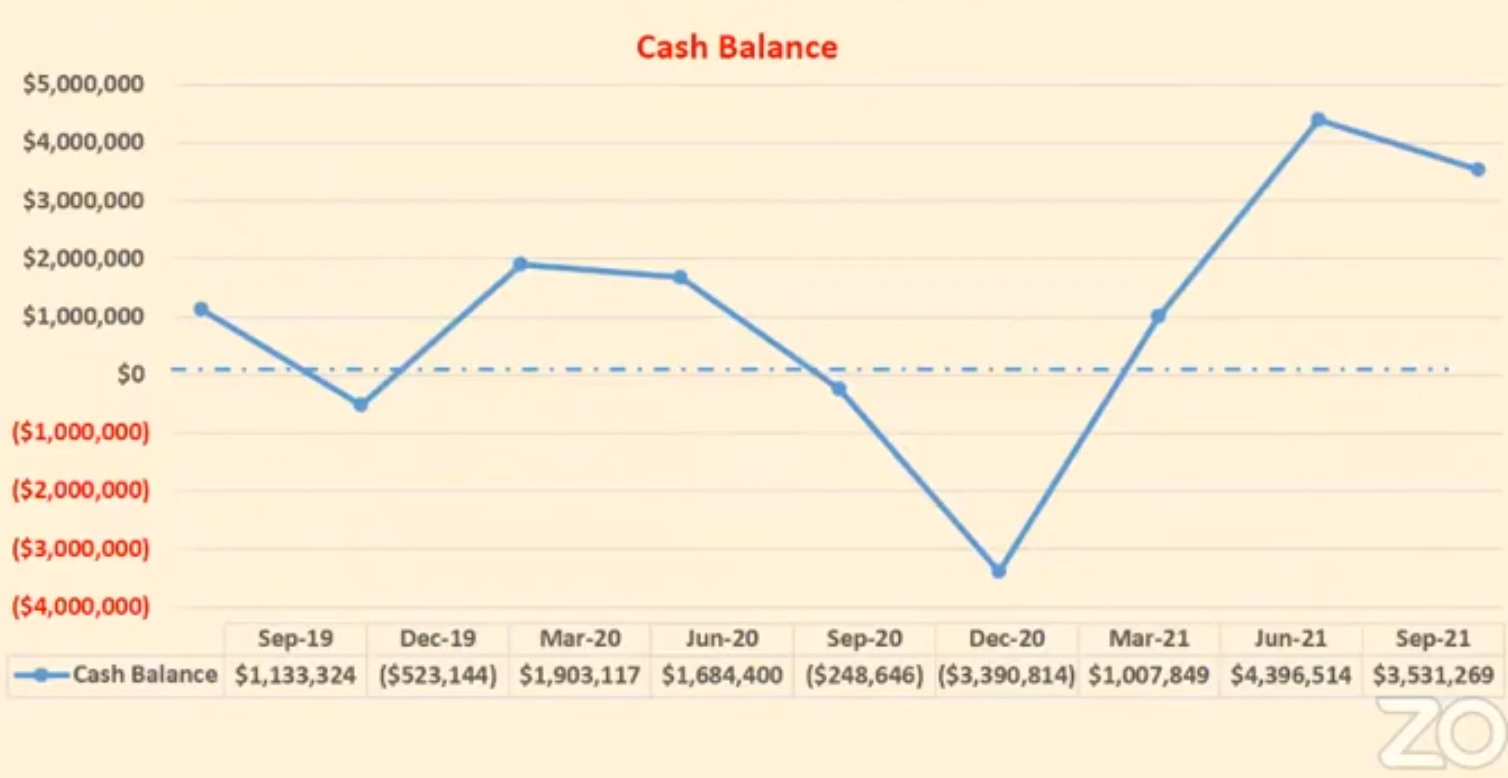

Despite dire projections of shortfalls and cuts to police amid the coronavirus pandemic and budget discussions, a financial update presented to the City Council last week shows Citrus Heights concluded the last fiscal year with revenues of $6.2 million more than anticipated.

From 2020: 10-year budget forecast for Citrus Heights looks grim

A staff report shows the city had budgeted for $30.7 million in revenue during the past fiscal year, but ended up with $36.9 million by the time the fiscal year ended June 30, 2021.

“We budgeted an operating shortfall of $3.7 million last year, (but) we actually ended the year with a surplus of $3.6 million,” Interim Administrative Services Director Bill Zenoni told the council in an Oct. 28 update. He also said the budget had anticipated utilizing $1.2 million of the city’s line of credit, but the city didn’t end up needing to do so.

Zenoni said reasons for the surplus included sales tax revenue exceeding expectations by more than $2 million. Due to the pandemic, the city had revised its budget to expect $11.1 million in sales tax, but ended up receiving $13.3 million due to increased online shopping.

Additionally, building permits and plan check fee revenues totaled $2.3 million, up by $1.4 million from the amount anticipated. The report attributed the increase to a rise in residential and commercial building activity.

One-time CARES Act funding of $1.1 million also boosted revenues and went towards public safety costs, as well as a $2 million federal and state reimbursement for costs the city fronted during a “Great Plates” restaurant stimulus program.

Budget savings of $1.9 million were also seen from vacant positions, and an additional $1.2 million was saved in operating costs associated with COVID-19.

The city’s $15.6 million in American Rescue Plan Act relief funds is not included in the totals, but will be included in the current fiscal year, which extends from July 1, 2021 to June 30, 2022.

Zenoni said the current fiscal year’s budget is projected to have a small shortfall of $100,000, but said actual revenues are anticipated to make up that difference.

Various council members asked several questions for clarification during Zenoni’s presentation, and Councilman Tim Schaefer voiced some concern about city projections being off by a significant amount, pointing particularly to building permits.

“My concern is we made a lot of decisions based on this info that we had at the time… a lot of things were done based on the numbers we had and now we’re looking back and we probably could have saved ourselves a little bit of heart ache,” said Schaefer, referencing budget cuts last year.

Zenoni replied that staff weren’t sure when major building projects like Mitchell Village would pull permits and also said the surplus revenues are “one-time revenues” that can’t be relied on in future years, looking at the city’s 10-year financial forecast.

Surplus revenues appear to be going to increasing the city’s General Fund reserves, which have dipped dangerously low. Zenoni said the surplus has put the city in a much better position this year, noting reserves are needed to cover gaps in cash flow.

The city’s revised 10-year financial model now shows funding available for a small amount to be budgeted for roads, beginning with $600,000 in fiscal year 2023-24, followed by $2-3 million per year in years following. The amount is still far short of the $7-12 million per year the city has cited as needing for road repairs in the past, but additional funding for roads comes from Measure A and gas tax funds each year.

Councilman Bret Daniels said in closing remarks that “it’s nice to see that we have more than we expected and we spent less than we thought we would. It doesn’t get any better than that, I think.”